Paymaster for Business Transaction

Companies and institutions who trade internationally with commodities, bank instruments or agricultural products need reliable partners. Payments of fees and comissions must be handled quite safely and on time around the world. Legal requirements, international compliance needs and regulations must be observed and taken into account carefully.

Request for paymaster services and analysis

As all funds transfer operations, paymaster services are worldwide regulated by national and international rules, regulations, governments and financial institutions.

For new clients we have to analyse by law every new case before we can make a serious offer or present a structure.

This analysis includes the following services and results:

- sorting and study of all related documents

- study of the transaction related contracts

- scam check: verification of the involved parties and the documents

- resume with an offer about a deal structure and quotes for the transaction

- drafting of a paymaster contract with all involved parties

The fix fee for a new case analysis is 5,000 Euro. We deliver your individual analysis within 3-5 working days. In urgent cases, you get your analysis within 24 hours. The fix fee for a 48 hours analysis is 8,000 Euro.

If you agree the procedures and conditions, you can pay the analysis fee by wire transfer.

We will come back to you within 48 hours after receiving the payment.

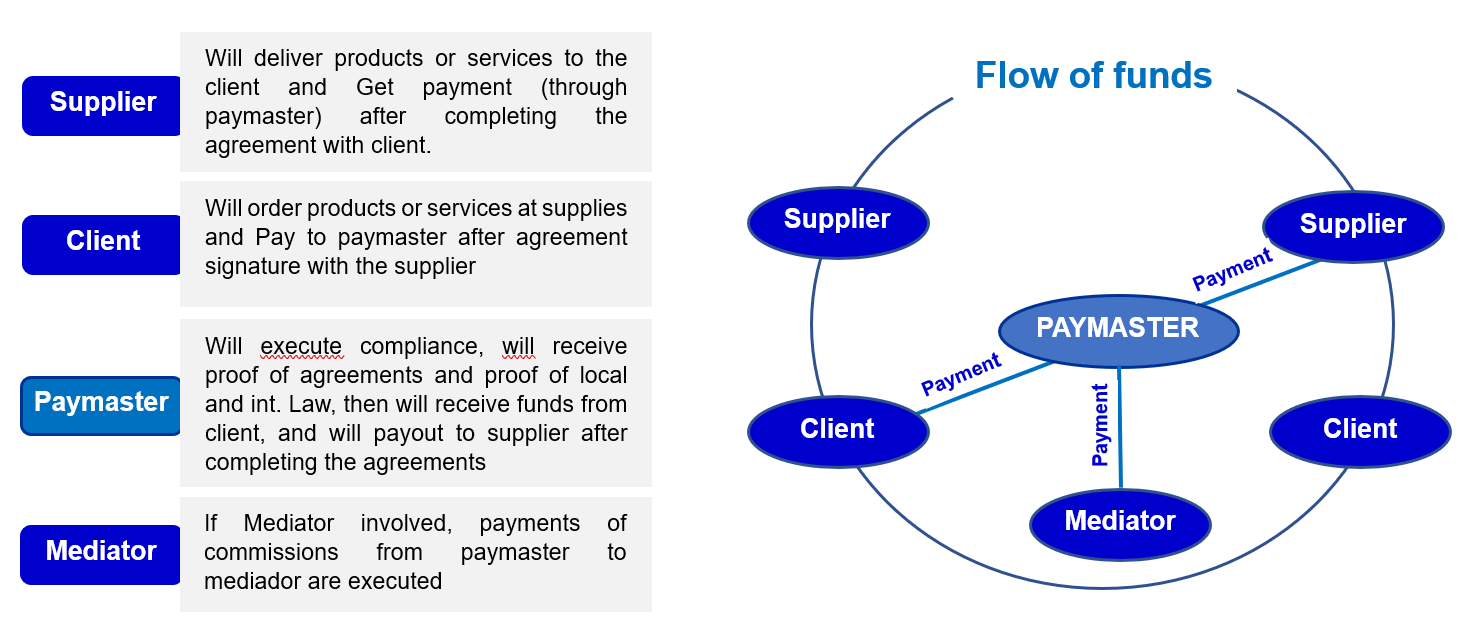

Structuring and executing payment transactions

- Experienced traders, such as buyers and sellers, agents, brokers and intermediaries use our services as independent international Paymaster located in Europe. Acting independently as a neutral third party on behalf of all partners involved, we shall support you to build deeper trust with your business partners.

- Authorized and registered as Financial company, Icarus Investment supports their clients immediately and in the long run in international businesses and financial transactions.

- This facilitation of large payments provides more security, reliability and confidence in your worldwide commodities, agricultural and financial instruments trade. Our International Paymaster Services in Europe can support your long term sustainable growth.

- Upon request and as part of our international legal advisory services, we also accept mandates about drafting and tailoring all contracts and agreements.

Paymaster Process Execution

Commodities, Agricultural, Financial trading

As seller or buyer, agent, broker or of intermediaries our clients need to handle fees and commissions of international transactions – and they have to transfer these funds regularly to various recipients (Beneficiaries). Icarus Investment support their clients with International Paymaster Services in Europe – and on special requests also in other preferred jurisdiction worldwide.

Once the deal has been concluded and fees and commissions are paid, we care for the management and disbursement through a single and secure Paymaster account. As an independent third party and financial intermediary we are supporting our legal clients primarily in the following transactions:

- Private Placement Programs

- Charity transactions

- Charity funds management

- Funds- and asset management

- Private Investment Programs

- Capital market transactions

- Real Estate transactions

- Bank instruments

- Bank guarantees

- Currency Transactions

- Crypto Transactions

- Crude Oil, Petroleum Gas, Jet Fuel…

Requirements

Each paymaster project must be legally structured. Especially concerning international money laundering laws are to respect numerous factors and rules. In some cases, it is necessary to develop and build a structure (holdings, banks, foundations …) In the assessment and evaluation of each project, our team aims to develop an optimal structure for the transactions. This is always associated with considerable effort.

Ask for a paymaster offer

To make an offer and to pre-evaluate your project, please send us the following information:

- what is your exact rule in the transaction: are you the sender, receiver or a mediator?

- volume of funds

- is it a one-time transaction or do you plan periodical transactions?

- what is the business case: delivery of products, finance- or service contracts?

- sender of funds (individuals or companies? Who? Where?)

- location of funds (country and bank)

- receiver of funds (individuals or companies? Who? Where?)

- location of receiver of funds (country, which bank?)

- final destinations of funds (who, country, bank?)

- are mediators involved? (who? where located? how is the commission?)

- do you need the set up for a structure? (company set up, off shore? on shore? where?)

The Procedures

- You request all necessary information and documents through our website contact form, e-mail.

- Our Paymaster then establish a personal communication with you – as trust and transparency through personal communication are the basic values underlying all of our services. We shall send out the documents that need to be executed as well as a detailed description of the procedure.

- Please note that by law we are obligated to make a legal and tax due diligence in all paymaster transactions. Especially the money laundering rules and laws have to be proved and respected.

- Our group works with leading banks in Europe

- Documents you receive include

- Client Information Sheet – your personal and contact as well as possibly company details. When returning it please do attach a scan of your valid passport or personal ID

- Paymaster Agreement (PA) – the basic document of our mandate. This PA will be valid for all future transactions

- Addendum A – information from payer/s. This form needs to be executed with the personal and contact details of the party/ies who will be sending funds to the Paymaster account;

- Addendum B – information from beneficiary/ies. This form needs to be executed with the personal and contact details of the party/ies receiving funds from the Paymaster account. Please do attach a scan of a passport or personal ID for every beneficiary.

- We need all relevant underlying contracts and fee agreements of your transaction(s), such as SALES AND PURCHASE AGREEMENTS, IRREVOCABLE MASTER FEE PROTECTION AGREEMENTS , SUB FEE PROTECTION AGREEMENTS…. This is needed to fully document the legitimate origin of the funds (source of capital) credited to the Paymaster trust account.

- Notarised photocopies of personal identification documents (passport / ID) of all beneficiaries

- After a one time advance fee has been credited to our business bank account to cover the costs for set up, due diligence is finalized and constant communication with all parties involved is opened.

The fees

To keep the costs in this phase for our clients within manageable limits, we provide the project evaluation and structuring (due diligence), depending on the complexity, at a flat fee about 5,000, – to 25,000, – €. For the transaction we charge a commission between 0,5 and 5% of the volume, also depending by the complexity and volume.

- Due Diligence of the project (legal, money laundering, tax issues…) 15- 50,000 Euro depending by the complexity, involved parties, countries and the volume

- Setup fees for all transactions (document proving, bank agreements, communication), fix fee: 5,000,- 8,000 Euro

- Transaction volume until 500,000 Euro: 5%

- Transaction volume 500,000 Euro – 1,000,000 Euro: 3%

- Transaction volume over 1,000,000 Euro: 2,5%

All fees are excluding bank and wire transfer fees.